Rent to Purchase: Affordable Solutions in Texas

Rent to Purchase, also known as lease-to-own, is a flexible and cost-effective solution for acquiring heavy equipment, especially for businesses in Texas. This article explores what Rent to Purchase entails, its benefits, and how you can take advantage of this option with Presta Fácil. Whether you’re a small business owner or a construction machinery worker, this guide will help you understand the advantages of Rent to Purchase.

What is Rent to Purchase?

Rent to Purchase is a financing option that allows businesses to lease equipment with the option to buy it at the end of the lease term. This method provides the flexibility of renting with the long-term benefits of ownership, making it an ideal solution for businesses in Texas looking to manage their cash flow while securing essential assets.

Benefits of Rent to Purchase

- Affordability: Spread the cost of the equipment over time, making it easier on your budget and cash flow.

- Flexibility: Offers the ability to use the equipment immediately without a large upfront investment.

- Ownership Option: At the end of the lease term, you have the option to purchase the equipment, often at a reduced price.

- Tax Benefits: Potential tax advantages, as lease payments may be deductible as business expenses.

- Maintenance and Upgrades: Many lease agreements include maintenance, and you have the option to upgrade to newer equipment at the end of the lease.

How Does Rent to Purchase Work?

- Application: Start by applying for a Rent to Purchase agreement with a reputable provider like Presta Fácil.

- Approval: Once approved, choose the equipment you need for your operations.

- Lease Agreement: Sign a lease agreement outlining the terms, including the duration, monthly payments, and purchase option.

- Use the Equipment: Begin using the equipment for your business operations immediately.

- End of Lease Options: At the end of the lease term, decide whether to purchase the equipment, return it, or upgrade to new equipment.

Understand the full process in our detailed guide on How Rent to Own Works.

Interested? Contact Us to start your Rent to Purchase application today!

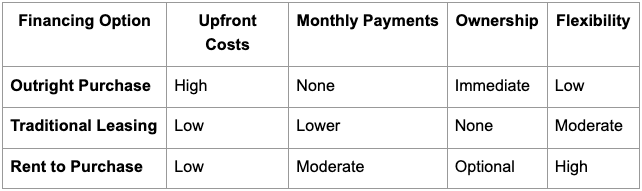

Comparison with Other Financing Options

Rent to Purchase combines the flexibility of leasing with the benefit of ownership, offering a balanced approach to equipment financing for businesses in Texas.

Tips for Choosing the Right Equipment

- Assess Your Needs: Determine the specific requirements of your projects and the equipment necessary to meet them.

- Consider Future Growth: Choose equipment that can handle potential increases in workload as your business expands.

- Evaluate Maintenance Costs: Look into the long-term maintenance needs and costs of the equipment to ensure it fits within your budget.

- Consult Experts: Seek advice from equipment specialists to make well-informed decisions and choose the best option for your business.

Learn more about Rent to Own for Heavy Equipment.

Why Choose Presta Fácil for Rent to Purchase?

- Easy Application Process: Simple and quick application process with fast approval times, making it easy to get started.

- Competitive Rates: Affordable monthly payments and competitive purchase options to suit your budget.

- Comprehensive Support: Ongoing support and maintenance throughout the lease term, ensuring your equipment stays in top condition.

- Trusted Partner: Presta Fácil is a reliable and experienced partner in equipment financing, trusted by businesses across Texas.

Conclusion

Rent to Purchase is an excellent option for businesses looking to acquire heavy equipment without the burden of a large upfront investment. With the flexibility to lease and the option to own, it offers both short-term and long-term benefits. Consider partnering with Presta Fácil to explore your Rent to Purchase options and get the equipment you need today.

Start Your Application Today.

FAQ Section

- What is Rent to Purchase?Rent to Purchase is a financing option that allows you to lease equipment with the option to buy it at the end of the lease term.

- What are the benefits of Rent to Purchase?Benefits include affordability, flexibility, ownership option, tax benefits, and maintenance/upgrades.

- How can I start a Rent to Purchase agreement with Presta Fácil?Start by applying online, get approved, sign the lease agreement, and begin using your equipment.

- How does Rent to Purchase differ from a regular lease?Rent to Purchase includes an option to buy the equipment at the end of the lease term, whereas a regular lease typically does not.

- Are there any upfront costs associated with Rent to Purchase?Depending on the agreement, there may be a small initial payment, but it is generally much lower than purchasing the equipment outright.

- What happens if I decide not to purchase the equipment at the end of the lease term?You can return the equipment, extend the lease, or upgrade to newer equipment.